Investing in land can be one of the most rewarding ventures in real estate, but it requires careful analysis and strategic thinking to ensure profitability. This guide will explore critical factors that can help you identify profitable land investments. By understanding these key indicators, you can make informed decisions and maximize your returns in the real estate market.

1. Location, Location, Location

Proximity to Urban Centres

One of the most important factors in determining land profitability is its location. Land close to urban centers or within areas experiencing rapid population growth is generally more valuable. Proximity to cities like Lagos or Abuja in Nigeria means higher demand for residential, commercial, and industrial use.

Accessibility

Easy access to major roads, highways, and public transportation increases the attractiveness of a land parcel. Investors and developers prefer locations with good infrastructure as it reduces the cost and complexity of developing the land.

Neighbourhood Quality

The quality of the surrounding neighbourhood plays a crucial role in land investment and value. Areas with low crime rates, good schools, healthcare facilities, and shopping centres are more desirable. Prospective buyers and tenants are willing to pay a premium for land in safe and well-serviced neighbourhoods.

2. Market Trends and Economic Indicators For Profitable Land Investment

Real Estate Market Trends

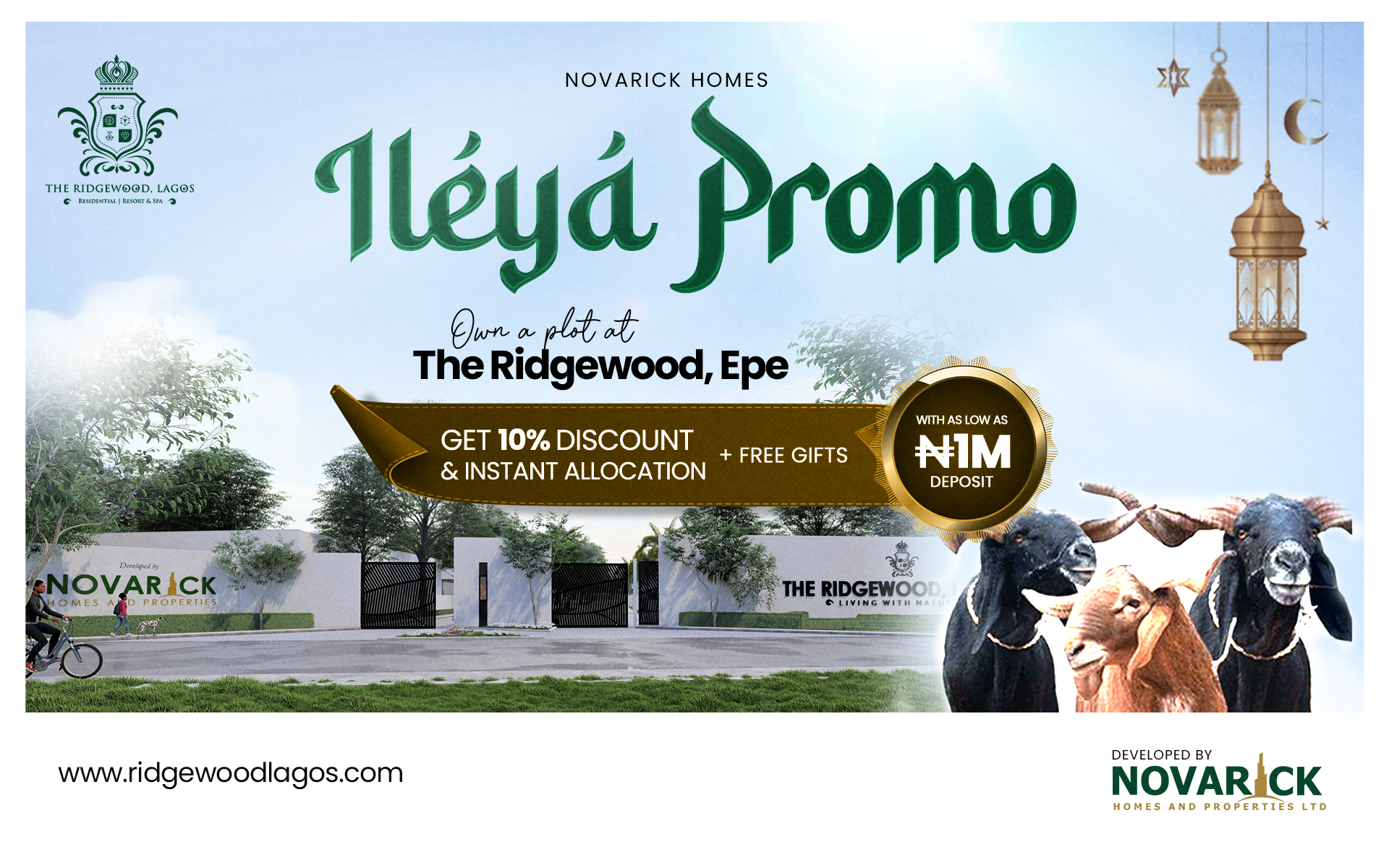

Staying informed about current real estate market trends is vital. Analyse recent sales data, price trends, and market forecasts to gauge the potential appreciation of land value. In Nigeria, areas like Lekki, Ikeja, Victoria Island, and Epe have shown consistent growth, making them attractive for investment.

Economic Growth

A region’s economic health significantly impacts real estate values. Look for areas with strong economic growth, low unemployment rates, and a thriving job market. Economic stability attracts businesses and residents, driving up demand for land.

Government Policies and Incentives

Government policies can greatly influence land profitability. Tax incentives, grants, or subsidies for development projects can enhance the attractiveness of certain areas. Additionally, favourable zoning laws and development regulations can facilitate profitable investments.

3. Land Use Regulations

Land Use Laws

Understanding the zoning/Land use laws of a potential investment area is essential. Zoning dictates how land can be used—residential, commercial, industrial, or mixed-use. Ensure the land is zoned for your intended use or that rezoning is possible. Land with flexible zoning options offers more opportunities for development.

Future Development Plans

Research the local government’s development plans. Areas slated for infrastructure improvements, such as new roads, schools, or business districts, typically experience significant value appreciation. Knowing future development projects can give you a competitive edge in selecting profitable land.

Environmental Restrictions

Be aware of environmental regulations that might affect land use. Wetlands, flood zones, and protected areas can restrict development and reduce land value. Conduct thorough due diligence to avoid investing in land with significant environmental limitations.

4. Infrastructure and Utilities

Existing Infrastructure

Land already equipped with essential infrastructure—roads, water supply, sewage systems, and electricity—is more attractive and valuable. Development costs are lower when these utilities are readily available.

Planned Infrastructure Projects

Anticipate the impact of planned infrastructure projects. New highways, bridges, or public transportation systems can dramatically increase land value. Investing in land before these projects are completed can yield substantial profits.

Utility Access

Ensure the land has access to necessary utilities. Lack of electricity, water, or sewage services can hinder development and reduce the land’s appeal. Evaluate the cost and feasibility of connecting to existing utility networks.

5. Topography and Soil Quality

Topography

The physical characteristics of the land, such as elevation, slope, and drainage, affect its usability and value. Flat or gently sloping land is easier and less expensive to develop than hilly or uneven terrain. Proper drainage is essential to prevent flooding and ensure land stability.

Soil Quality

Soil quality impacts construction costs and agricultural productivity. Conduct soil tests to determine its suitability for building or farming. Poor soil conditions may require costly remediation, reducing overall profitability.

Environmental Hazards

Assess the land for potential environmental hazards, such as contamination or proximity to industrial sites. Clean-up costs can be significant, and ongoing risks may deter potential buyers or tenants.

6. Comparable Sales and Market Analysis

Comparative Market Analysis (CMA)

A Comparative Market Analysis (CMA) helps you determine the fair market value of the land by comparing it to similar properties that have recently sold in the area. Analyse factors like size, location, and zoning to understand the land’s competitive positioning.

Appraisal Reports

Professional appraisals provide an unbiased estimate of the land’s value. Appraisers consider various factors, including market conditions, property features, and local economic indicators. An appraisal report can guide your investment decisions and negotiations.

Market Demand

Understand the current demand for land in the area. High demand with limited supply often leads to price appreciation. Engage with local real estate agents, attend property auctions, and monitor listings to gauge market activity.

7. Investment Potential and Exit Strategy

Appreciation Potential

Evaluate the long-term appreciation potential of the land. Areas with ongoing development, economic growth, and infrastructure improvements typically offer better appreciation prospects. Consider the historical performance and projected growth trends that make the land investment profitable.

Income Generation

Identify opportunities for generating income from the land, such as leasing it for agricultural use, parking, or temporary storage. Income-generating land can provide cash flow while waiting for capital appreciation.

Exit Strategy

Develop a clear exit strategy before investing. Whether you plan to sell the land after a few years, develop it into residential or commercial properties, or hold it for long-term appreciation, having a defined plan helps you stay focused and make informed decisions. This will ensure you are on the right track to profitable and investment.

In conclusion, identifying profitable land investment requires thorough research and analysis. By considering factors such as location, market trends, zoning regulations, infrastructure, topography, and investment potential, you can make informed decisions that maximize your returns. Stay updated on local market conditions, engage with real estate professionals, and conduct comprehensive due diligence to identify and capitalize on lucrative land investment opportunities in Nigeria. With the right approach, land investment can be a rewarding and profitable venture in the real estate market.