Different types of real estate offer unique investment opportunities and challenges. In this blog post, we identified key factors investors should consider when contemplating between commercial and residential real estate investment.

Understanding these key differences will help you make better decisions on your real estate journey, whether you are a seasoned investor or a newbie.

What Are Commercial Real Estate Properties?

Commercial properties are developed for business purposes. They include a wide range of property like

- Office buildings: For administrative and professional functions.

- Retail spaces: Shops, malls, and shopping centers.

- Industrial properties: For Warehouses, factories, and distribution operations.

- Hospitality properties: For hotel lodging, motels, and resorts use.

Benefits Of Commercial Property Investment

- Commercial properties require higher investment funds compared to residential properties.

- It involves longer lease agreement between owners and tenants which provides more stable income streams for investors.

- Commercial properties require specialized knowledge and skills on lease agreements and tenant relations for effective management and maximum returns.

- Although commercial properties risks are higher, it also potentially offers higher returns on investment.

What Are Residential Real Estate Properties?

Residential properties are developed for affordable living purposes, including single-family homes, multi-family homes, mobile homes and so on.

Benefits Of Residential Property Investment

- Unlike commercial properties, residential properties investment requires a lower entry fund.

- Residential properties are meant mostly for short term lease for more ownership control and usage flexibility.

- Residential properties require little management knowledge and skills compared to commercial property management. It can be managed personally by the property owner.

- Residential rentals provide investors with a steady income stream, especially in stable markets with high housing demand.

Factors to Consider When Choosing Between Commercial And Residential Property Investment

- Investment goals: Understand what investment returns goal is, i.e short-term income, long-term appreciation, or a combination of both. This will help you make a decision on what property type to choose that will generate your desired income stream.

- Risk tolerance: Know your tolerance level with risk, commercial properties have higher risks associated with them while residential properties have lower risk.

- Time commitment: Do you have the time and effort required to manage each property type? Or would you rather hire a professional manager to handle it on your behalf?

- Market conditions: Conduct due diligence of the current market situation for both commercial and residential properties in your desired investment location.

Conclusion

The best choice of investment in either commercial or residential property depends on individual investor circumstances, goals, and risk tolerance. Consider the factors highlighted in this blog to make informed decisions on property type that aligns with your investment goals.

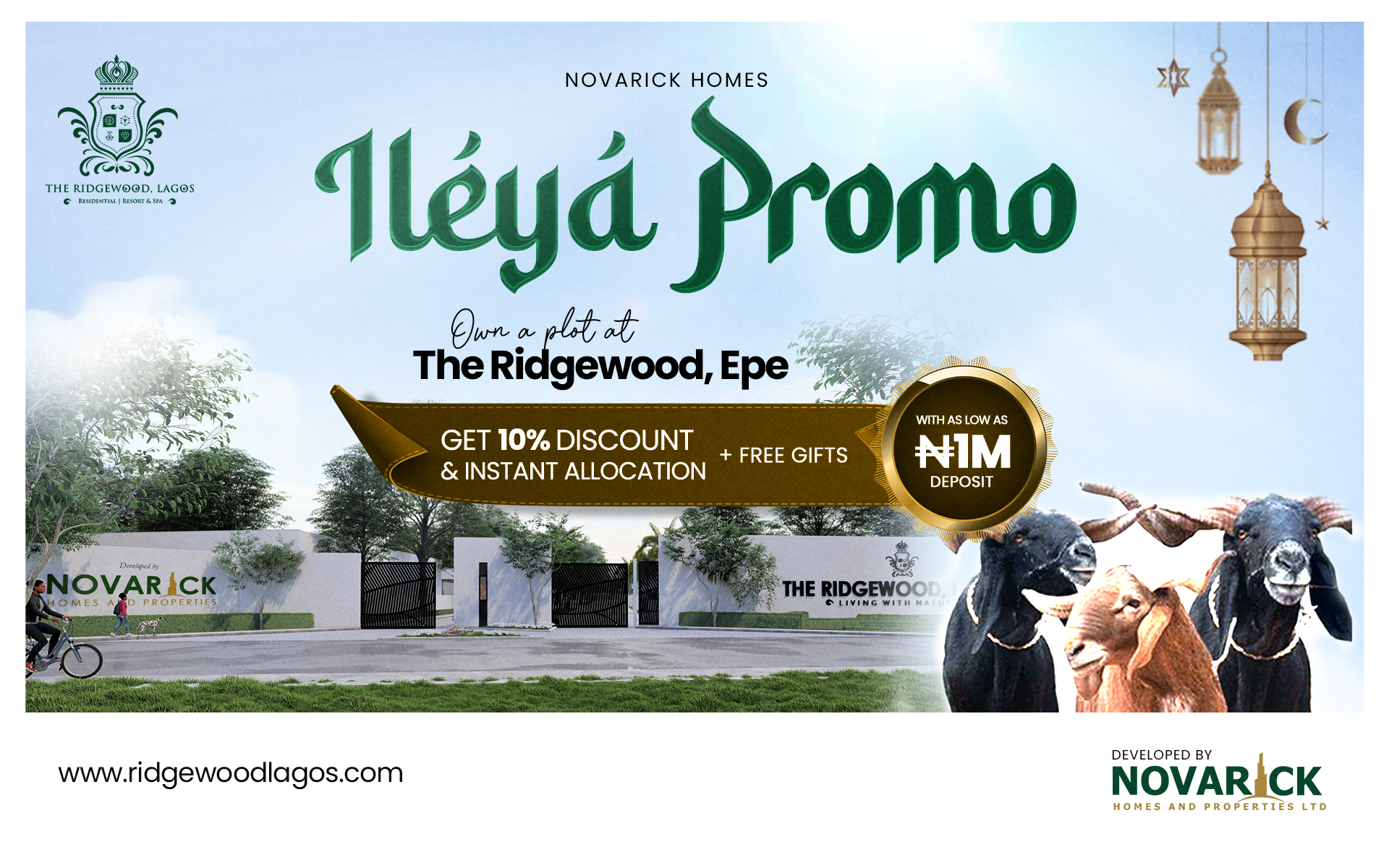

At Novarick Homes and Properties Limited, we have a variety of properties in prime locations suitable for commercial and residential purposes. With our expertise in property development, management and investment, we are dedicated to providing exceptional service and exceeding your expectations.

Visit our website to view our listings of available property like and start your journey to profitable real estate investment.