Whether you are buying a home or investing in a real estate property, appraising the property value is very important.

In this blog post, we highlighted the different methods used in property appraisal and the importance of hiring a qualified appraiser. You will also learn about the factors that can influence a property’s appraisal value.

What Is Real Estate Property Appraisal?

A property appraisal is a professional assessment of a property’s market value. It is done taking into consideration factors such as the property location, condition, size, and recent comparable sales value.

Factors That Property Appraisal Value

- Location: The location of a property significantly impacts its value like its proximity to essential amenities, road networks, and so on.

- Property Size and Condition: The size of the property, including land and building, as well as its condition, are essential factors. A well-maintained property with ample space is generally more valuable.

- Recent Comparable Sales: Appraisers compare the appraisal property to similar properties that have recently sold in the same area to determine its market value.

- Economic Factors: Economic conditions, such as interest rates, inflation and market trends, can influence property values. A strong economy with low interest rates can drive property prices up.

- Zoning and Land Use Regulations: Restrictions and regulations on land use can limit the potential uses of a property, affecting its value. For example, a property zoned for commercial use might be more valuable than one zoned for residential use.

Real Estate Property Appraisal Methods

Sales Comparison Approach: This method involves comparing your property to similar properties that have recently sold in the same area. Adjustments are made for differences in features, size, and condition of the property during its appraisal.

Cost Approach: This method estimates the cost of replacing the appraised property with a similar one. Depreciation on the property is considered to account for age and condition of the existing property.

Income Approach: This method is used to determine the appraisal value of income-producing properties, such as rental properties or commercial buildings. It estimates the potential income the property can generate and then applies a capitalization rate to determine its appraisal value.

Why You Should Hire A Professional Property Appraiser

- A reliable appraisal can help you determine a fair market value and negotiate a fair price on your behalf.

- Lenders often require an appraisal to assess the property’s value to ensure that the loan given is appropriate for the lender.

- An appraisal can provide you with valuable insights into your property’s value and how it compares to similar properties in the area.

Conclusion

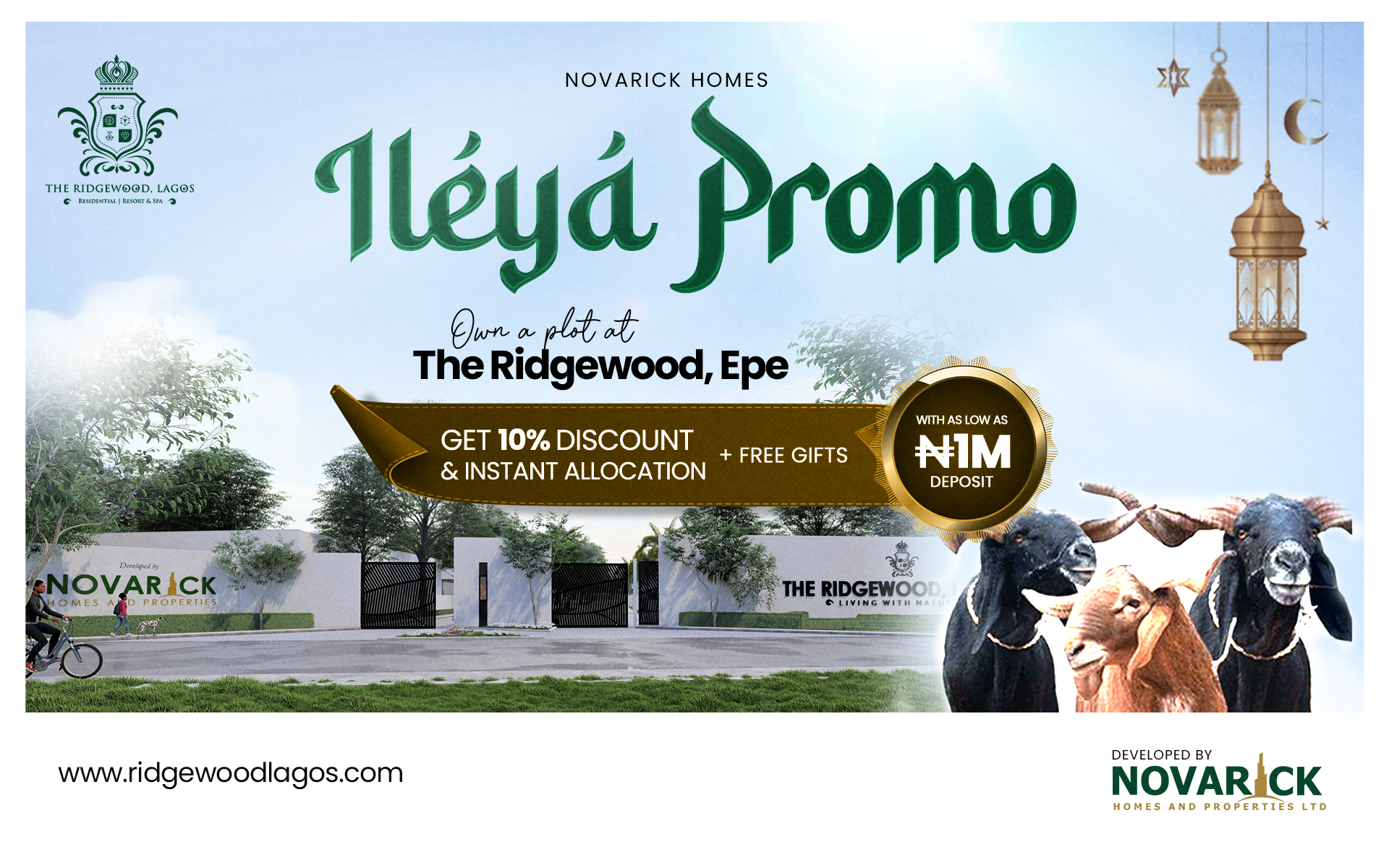

At Novarick Homes and Properties Limited, we provide property developments, investment, property procurement, advisory, joint ventures, and facility management services.

Whether you are buying, selling, or investing in property, our team of dedicated professionals is here to guide you every step of the way. We pride ourselves on providing personalized service, tailored solutions, and expert advice that exceeds your expectations. Visit our website to know more about our service and how we can help you make the most of your real estate investment.